Please choose one of the Criteria headings for a list of the topics under each, or select from the A-Z list. You can also find a ‘Search’ tab on the right-hand side of the page to review our top questions or search our Criteria.

For anything you are unable to find you can use our ‘Chat to us’ Webchat facility or contact your BDM.

A-Z Lending Criteria

-

- Certifying Documents

- Changing Property Address

- Cladding & EWS1

- Commitments and outgoings

- Concessionary and family purchase

- Consent to let

- Contractors

- Decision in Principle (DIP)

- Dependants

- Deposit acceptance and documentation

- Direct Debit Details

- Discount Market Scheme (DMS)/ Resale Price Covenant (RPC)

- Distressed sale and leaseback

-

- Early Repayment Charges

- Employment/Self Employment Min Time

- Energy Performance Certificate (EPC)

- EWS1 and Cladding

- Existing Halifax Customer Moving Home

- ExPats

- Family Purchase/Concessionary

- Fee Payment - Acceptable Cards

- Financial Difficulty

- Finders Fees

- First Homes Scheme

- First Monthly Payment & Initial Interest

- First Time Buyers (FTB)

- Foreign income

- Foreign nationals

- Foster income

- Further Advance

-

-

-

-

-

- Scottish Properties

- Second Home Loan

- Second Job

- Section 106 planning agreements / restrictive covenants

- Self Build

- Self Employed Keying & Evidence

- Self Employment/Employment Min Time

- Shared Equity (including Help to Buy)

- Shared Ownership

- Sub Sales & Back to Back transactions

- Subsequent Charges (SCG)

- Unencumbered Property

- Valuation

- Valuation Reports & Surveys

- 90-95 loan to value

- Acceptable Property Types

- Adverse Credit

- Affordability, LTI and Income Multiples

- Age Min/Max

- Appeal Credit Score Decline

- Applicants, Number of

- Arrears for PT & FA

- Assignable Contracts

- Back to Back Transactions & Sub Sales

- Background Mortgages (incl BTL) and Non-Simultaneous Sale

- Bank of England base rate changes

-

Bankruptcies/IVA/Debt Management

The Credit History question should be answered as ‘Yes' if any customer has had a Bankruptcy / IVA / Debt Management Arrangement / Debt Relief Order or made a formal or informal Arrangement/Order with a debt management provider/creditor to agree a revised payment less than the contractual monthly payment, which was:

Registered within the last 6yrs (whether now completed or not)

Or

Is still outstanding (whenever this was registered)

If a Bankruptcy / IVA / Debt Management Arrangement / Debt Relief Order or formal or informal Arrangement/Order with a debt management provider/creditor to agree a revised payment less than the contractual monthly payment was registered over 6yrs ago and is no long outstanding, the question can be answered as ‘No’.

Where a customer has agreed an arrangement within the terms of their contract (e.g. a payment holiday) this does not need to be declared.

CCJ

The Credit History question should be answered as ‘Yes' if any customer has had a County Court Judgement (CCJ) or default registered against them, or if self employed against their business, within the last 6 years. CCJs are generally taken into account in credit scoring however background details are required.

Mortgage Arrears

The Credit History question should be answered as ‘Yes' if any customer has been in arrears in the last 6 years with any borrowing or ever had a property repossessed. Applications where previous mortgages have been in arrears will be considered on an individual basis.

-

Simultaneous sale and purchase is the preferred route, but we recognise that this is not always possible.

Existing property is for sale but will not be sold before new mortgage completes - The existing mortgage payment must be keyed as a credit commitment and will be included in the affordability calculation.

Existing property to be rented out - The mortgage payment must be keyed as a credit commitment (the mortgage type for the commitment needs to by keyed as ‘Buy to Let'). The rent received should be keyed as 'Rental Income (if rental property)'.

Other Buy-to-Let mortgaged properties owned - The mortgages must be keyed as individual credit commitments and the total rent received keyed as 'Rental Income (if rental property).

-

A dependant is anyone who is financially reliant on your customer, who is not a party to the mortgage and does not contribute to the mortgage payments. A dependant may be a child, spouse not party to the mortgage, adult or elderly relative or a future dependant.

You need to capture separately both Child and Adult Dependants.

Child Dependant

A child dependant would include any children for which the customer(s) is the primary carer and who is under 18. A child dependant would include a future dependant where the customer is expecting a baby or is in the process of adopting a child. Foster children should be included as dependants.

Where any children have income and can fully support themselves they do not need to be keyed as a dependant.

If a child is not living with the customer(s) and maintenance is being paid, a dependant does not need to be keyed, but the maintenance amount must be keyed as a commitment.

Adult Dependant

An adult dependant is someone who is not party to the mortgage but is financially reliant on the customer. This could be a spouse/partner, elderly relative or grown up children who are unemployed or in full time education.

Where the adult dependant resides at the property for some of the time, you would key this in the adult dependant field.

Alternatively, where the customer financially supports an adult dependant who doesn't reside at the property, they would not be keyed as a dependant, but the related costs instead must be keyed as a total figure in “Other Commitments”.

-

All customers must make a minimum personal deposit for the property relevant to their individual credit score, product or scheme. No element of this deposit should be represented by a personal loan.

Where evidence of deposit is requested, the following documents are acceptable:

Gifted deposit

A genuine gift from a family member is acceptable as a source of deposit. If any of the deposit is gifted, this should be chosen as the source of deposit when keying the application.

The definition of a family member is someone who is related to at least one of the applicants as follows:

- Relative by birth/blood or by marriage/civil partnership:

- Husband/wife or civil partners.

- Parents, step-parents, parents-in-law.

- Brothers and sisters, half brothers and sisters, step-brothers and sisters, brother and sister-in-laws.

- Applicants' children, step-children, son and daughter in laws and adopted children.

- Grandparents, step-grandparents.

- Uncle/aunt (must be related by blood and not marriage).

- Nephew/niece.

- 'Common Law' partners or co-habitees.

- Partners or ex-partners who are not co-habiting at the property.

Gifts from the following are not acceptable:- Friends, including family friends.

- Employers.

- Vendor, developer, landlord.

- Cousins.

- Foster/guardian children.

When proof is required you should obtain a letter written by the family member that includes all of the following, or a Gifted Deposit template letter (PDF, 38KB) is available for you to use.

- Addressed to Halifax.

- Dated within the last three months.

- Name and address of the person(s) gifting the deposit.

- Name and address of the applicant(s).

- The relationship between the person(s) making the gift and the applicant(s). They must be a family member. See definition of family member above.

- The property address being purchased.

- The amount of the deposit being gifted.

- The source of the gifted deposit e.g. savings.

- The gift is ‘not repayable' and the person(s) gifting the deposit 'will hold no interest in the property following completion of the mortgage'.

- Signed by the person(s) gifting the deposit.

You should also provide a UK bank statement or UK passbook from the family member or applicants showing the deposit funds in their account. Alternatively, the family member or applicant may provide a letter from their UK bank confirming that the funds are available. Additional statements may be requested where required.

Savings

You should obtain:

- The latest three months' UK bank statements or a UK passbook covering the latest three months' transactions showing the applicant's name, account details (sort code and account number for bank statements or account number for passbooks) and company name, or the latest annual statement for longer term savings plans

- The statements or passbook should be in the name of at least one of the applicants

- The latest closing balance must cover the total deposit required

- Any recent large or unusual deposit may require clarification to establish the source

- Where funds have originated from a business account, we may request confirmation from the accountant that the withdrawal will not have a negative impact on the business.

Forces Help to Buy (previously called Long Service Advance of pay)

Serving members of HM Forces may be able to raise capital for a deposit by means of a 'Forces Help to Buy' (FHTB) interest free loan which will be repaid by the customer through their pay.

This can be accepted as a deposit for a mortgage on a main residence or when using the Help to Buy Equity Loan scheme and the repayment must be keyed as a commitment.

FHTBs are repayable interest free over 10 years so to calculate the monthly payment, divide the amount borrowed under the FHTB scheme by 120.

Where the deposit is funded from FHTB, the deposit type should be keyed as savings. The applicant will not receive confirmation of the FHTB amount from HM Forces until they have received their mortgage offer, so there is no requirement to obtain evidence.

Concessionary

If the deposit is from equity (e.g. a reduced purchase price) the application should be treated as a concessionary purchase - refer to CONCESSIONARY PURCHASE FOR CRITERIA.

Vendor Deposits and Cashbacks (Non New Build Properties)

Vendor Gifted Deposits are an unacceptable source of deposit for any non new build property.

This does not impact buyers who are receiving gifted deposits to purchase New Build Properties or concessionary purchases.

-

We do not currently accept new business applications from ExPat residents.

-

Applications involving finder's fees are not acceptable.

A finder's fee is a fee or commission paid by a seller to a third party (such as an investment club) for finding or introducing a buyer. It does not include the normal fee or commission payable to any estate agent handling the sale.

-

The first monthly payment is always collected in the month following completion, for example if a mortgage completes in June the first payment will be collected in July. This will be collected on the customer’s chosen monthly payment date unless completion occurs in the last few days of any month and results in less than 4 working days between the completion date and the customer's chosen payment date (excluding those days), the first payment will then be collected on the 10th of that month. This date will then revert to the customer's chosen payment date on the following month.

The first monthly payment includes an amount of ‘Initial Interest’ from the day of completion to the end of that month plus the first monthly mortgage payment. For example:

- If completion occurs on the 15th, interest is calculated from the 15th to the end of the month and then added to the first payment

- If completion occurs on the 5th, interest is calculated from the 5th to the end of the month and then added to the first payment

The 'Amount of each instalment' section of the mortgage illustration sets out a first payment assuming a mortgage completes on the 1st of the following month. A customer’s first monthly payment may be different as it will depend on when the loan starts. We write to all customers when the mortgage starts to tell them when we will collect their first and subsequent payments.

-

The maximum loan amount available on interest only is 75% loan to value (LTV) (or for sale of mortgaged property (SOMP) main residence 50%, 60% or 75% depending on the minimum equity requirement). On part interest only/part capital and interest repayment customers can borrow up to 85% LTV with the balance on capital and interest repayment.

Check the maximum loan on interest only for all repayment plans, including Sale of Mortgaged Property (SOMP) repayment plans, using the interest only calculator.

All loans arranged where the capital element is not included in the monthly payment, including those that are part capital and interest repayment, part interest only, must have a plan in place to repay the capital at the end of the term. This includes new loans, further advances and product transfers.

As a responsible lender, it is important for us to see evidence of the repayment plan for interest only mortgages so documents relating to the repayment plan must be received before a new mortgage offer can be considered.

The repayment plan must cover the whole amount of interest only. This information is only a guide. A mortgage offer will only be issued once we have confirmed that the evidence supplied meets our criteria.

Bonus

There is a minimum income requirement for this repayment plan to be available:

- Sole applicant with an income of £75,000 or more

- Joint applicants where one applicant has an income of £75,000 or more, or where the combined income of both applicants is £100,000 or more. e.g. this could be £60k and £40k, therefore no applicant has an income of £75,000 or more but together their income is £100,000 or more

- The income requirement is calculated on the total of Basic, Overtime, Bonus and Commission for employed applicants or the latest year's income for self-employed customers.

The amount of this repayment vehicle which can be used is assessed by:

- An annual bonus figure is calculated from the payslips provided as evidence

- Where bonus is paid annually the average of the bonus received in the last 2 years is used

- 30% of this bonus figure is then multiplied by the term of the mortgage required for the amount of Interest Only lending available

- There is an expectation that the customer will make periodic lump sum repayments to reduce the amount outstanding during their Interest Only mortgage and it is important the customer understands this, however Early Repayment Charges would apply as normal where any overpayment concession is exceeded

- Where any Bonus is to be used as a repayment plan no bonus income earned by any customer will be used in the affordability assessment

- Lending Into Retirement - the term of any Interest Only lending must not exceed the lower of the Anticipated Retirement Age or Maximum Working Age of 70 where Bonus is being used as a Repayment Plan. The term can run up to 364 days past the lower of the ARA / MWA of 70.

Evidence of bonus income is required:

- If received monthly the latest 3 payslips. If received quarterly, the latest 4 bonus payslips

- If received half yearly then previous 2 payslips showing bonus payment

- If received annually then previous 2 years payslips showing bonus payment

- An average value should be calculated and used

- Bonus slip must show applicant & employer name, pay date and gross bonus amount.

Cash

There is a minimum income requirement for this repayment plan to be available:

- Sole applicant with an income of £75,000 or more

- Joint applicants where one applicant has an income of £75,000 or more, or where the combined income of both applicants is £100,000 or more. e.g. this could be £60k and £40k, therefore no applicant has an income of £75,000 or more but together their income is £100,000 or more

- The income requirement is calculated on the total of Basic, Overtime, Bonus and Commission for employed applicants or the latest year's income for self-employed customers.

The amount of this repayment vehicle which can be used is assessed by:

- Copy of statement dated within last month and a previous statement showing Cash amount held for a minimum of 3 consecutive months

- If a minimum £50,000 has been held in a savings or current account (£ sterling) for a minimum 3 consecutive months 100% of the current cash balance can be used to support Interest Only lending

- If the statements show a fluctuating cash balance then the lowest balance will be used

- If savings are also being used as source of deposit then evidence of an amount sufficient for both the repayment plan and deposit must be provided

- Lending Into Retirement – the term of any Interest Only lending must not exceed the Maximum Working Age of 70 where Cash is being used as a Repayment Plan.

Endowment

There is a minimum income requirement for this repayment plan to be available:

- Sole or joint applicants have a combined income of £50,000 or more

- The income requirement is calculated on the total of Basic, Overtime, Bonus and Commission for employed applicants or the latest year's income for self-employed customers.

The amount of this repayment vehicle which can be used is assessed by:

- Copy of latest projection statement dated within last 12 months

- Endowment companies will present three growth rates to a customer with the middle one (for example 6%) being the most likely projected outcome. We allow up to 100% of projected amount using the middle % figure.

Pension

There is a minimum income requirement for this repayment plan to be available:

- Sole or joint applicants have a combined income of £50,000 or more

- The income requirement is calculated on the total of Basic, Overtime, Bonus and Commission for employed applicants or the latest year's income for self-employed customers.

The amount of this repayment vehicle which can be used is assessed by:

- Copy of latest pension statement dated within the last 12 months

- The pension must have a minimum projected total fund value of £400,000 of which a maximum 15% of this amount will be used to support Interest Only lending

- Where a projected total fund value does not show on the pension statement e.g. on a final salary pension if the projected lump sum is at least £100,000 up to 60% of a projected lump sum value can be used

- Where a statement gives a range of projected values the middle of three figures or the lower of two would be used

- Pensions belonging to the same person can be combined to reach the £400,000 or £100,000 levels but pensions held by joint applicants cannot be combined to meet these levels

- Pension contributions should be collected under ‘Total monthly payment towards Investment Vehicles' and will be used within affordability calculations

- It is important the customer understands the need to maintain the pension contributions

- Lending Into Retirement - the term of any Interest Only lending must not exceed the lower of the Anticipated Retirement Age or Maximum Working Age of 70 where Pension is being used as a Repayment Plan. The term can run up to 364 days past the lower of the ARA / MWA of 70.

Sale of mortgaged property

Check the maximum loan on Sale of Mortgaged Property (SOMP) repayment plans, using the interest only calculator.

There is a minimum income requirement for this repayment plan to be available:

- Sole applicant with an income of £75,000 or more

- Joint applicants where one applicant has an income of £75,000 or more, or where the combined income of both applicants is £100,000 or more. e.g. this could be £60k and £40k, therefore no applicant has an income of £75,000 or more but together their income is £100,000 or more

- The income requirement is calculated on the total of Basic, Overtime, Bonus and Commission for employed applicants or the latest year's income for self-employed customers

There is a minimum credit score requirement for this repayment plan to be available. If applications do not meet this an alternative repayment plan would need to be selected.

The amount of this repayment vehicle which can be used is assessed by:

- The equity amount available in the property being mortgaged can be used to support Interest Only lending

- This will be calculated using the valuation/property assessment carried out as part of the application and any existing or new additional borrowing elsewhere to be secured against the property must be declared and will reduce the equity amount available

- If the property is to be a main residence there must be a minimum equity amount available. The equity amount is calculated as the property value minus interest only amount:

- Up to 50% interest only the minimum equity requirement will be £300,000

- For >50%-60% the minimum equity will be £500,000

- For >60%-75% the minimum equity will be £750,000

- For part Interest Only / part capital and interest repayment lending the minimum equity will be calculated at the end of the mortgage term, not at point of application.

- The maximum Loan To Value (LTV) on Interest Only is 75%; part interest only / part capital and interest repayment is available with the balance above the SOMP interest only amount, up to a maximum 85% LTV, on a capital and interest repayment basis.

- The term on any Capital & Interest Repayment element cannot exceed the term on Interest Only

- If the property is on the ‘second home' scheme the minimum equity requirement does not apply and a maximum LTV of 75% can be on Interest Only

- It is important the customer understands the requirement to sell their property at the end of the term to repay the Interest Only loan amount

- Lending Into Retirement – the term of any Interest Only lending must not exceed the Maximum Working Age of 70 where Sale of Mortgage Property is being used as a Repayment Plan (except where property is ‘second home' where a longer term may be considered).

Sale of other residential property

There is a minimum income requirement for this repayment plan to be available:

- Sole or joint applicants have a combined income of £50,000 or more

- The income requirement is calculated on the total of Basic, Overtime, Bonus and Commission for employed applicants or the latest year's income for self-employed customers.

The amount of this repayment vehicle which can be used is assessed by:

- Due to valuation and verification requirements this is restricted to properties within the UK

- Completed interest only - other residential property form and, if the mortgage lender is outside Lloyds Banking Group, a copy of the latest mortgage statement dated within last 12 months

- We will check the ownership of the other residential property and assess its value using an automated valuation (AVM). (Ownership of the other residential property must be in the same name as the applicants)

- We will compare the equity available in the property with the amount of interest only lending required

- Current equity within the property must be over £50,000

- We will use 80% of the current equity value of the property to support interest only lending

- If the valuation fails to sufficiently value the other property the customer could obtain a full valuation of the property (at their own cost) using a RICS certified surveyor

- Please note that there is a minimum greater than £50,000 equity requirement for each individual property being used to support Interest Only lending

- If the property is not already purchased, evidence required will also include; property details, Acting Solicitor to confirm intended ownership of the second property, details of any loans to be secured against this property (property valuation and land registry search carried out by us if needed). We will confirm the intended ownership of the second property prior to offer on the new mortgage / further advance.

Stocks and Shares (including ISA) and other investments

There is a minimum income requirement for this repayment plan to be available:

- Sole or joint applicants have a combined income of £50,000 or more

- The income requirement is calculated on the total of Basic, Overtime, Bonus and Commission for employed applicants or the latest year's income for self-employed customers.

The amount of this repayment vehicle which can be used is assessed by:

- Only UK based investments quoted within the FTSE index held in sterling are acceptable

- Unit trusts / Open Ended Investment Companies / Investment Bonds (UK) allowed

- Copy of share certificates, nominee account statement or confirmation from a recognised stock broker containing evidence of share holdings together with their valuation

- Copy of latest ISA statement dated within last 12 months

- The amount of interest only cover available will be 80% of the current value of the investment which must be greater than £50,000

- The total can be made up of a combination of Stocks and Shares ISA, Unit Trusts, Investment Bonds and Stocks and Shares.

Important points on the assessment:

- We are not providing advice on your customer's repayment plan(s) or making any guarantee that their plan(s) will be sufficient to repay the outstanding balance (capital) at the end of the mortgage term.

- Your customer should review their plan(s) regularly during the term of their mortgage to make sure it is on track to repay the outstanding balance.

- Periodically, we will ask your customer to provide evidence of their repayment plan(s). If your customer is unable to satisfy us that their repayment plan(s) remains on track to repay the outstanding balance on their mortgage, we may ask your customer to transfer some or all of their mortgage onto a capital and interest repayment basis.

- Please remember it is your customer's responsibility to ensure they have sufficient funds to repay their outstanding balance at the end of the mortgage term. If they are unable to do so, their home may be repossessed to repay the outstanding balance.

Important points on repayment plans:

- Repayment plans CANNOT be accepted if they include the name of anyone NOT named on the mortgage.

- Your customer can use more than one repayment plan to cover their total interest only amount. In this case, please send the relevant evidence for all repayment plans.

- The following are NOT acceptable repayment plans:

- Sale of other commercial property.

- Sale of non property assets.

- Inheritance.

- Maturity dates will be requested for each applicable repayment plan

- The mortgage term must finish before a maximum age of 70 years rather than 80 years for repayment mortgages. For pension and bonus repayment plan types the maximum term would be restricted further if there was a lower anticipated retirement age.

Only repayment vehicles for those customers intending to live at the mortgaged property may be used to support the loan. E.G. if a parent is named on the mortgage to help with affordability then a property in the parents name cannot be accepted as a repayment vehicle.

Existing Halifax mortgage customers moving home

If an existing customer does not meet the current interest only rules we may consider allowing interest only on the new mortgage up to the level held currently, provided the mortgage term is not increasing. Please refer to your BDM for guidance.

-

The maximum age at the end of the mortgage term is 80 years for all lending.

Future retirement income will need to be verified where the customer is taking a mortgage term which extends beyond the earlier of their anticipated retirement age or a maximum working age, for which we will use 70 or 75. Affordability will be assessed on the future retirement income. On occasions, a further review will be required to confirm we feel it is appropriate for the customer to lend into retirement.

The applicant's plans should be discussed in view of their occupation, and reasonability of working beyond state pension age should be documented where appropriate.

We will require a ‘Customer Working Age form’ (PDF, 3.14MB) to be completed by all customers on an application where the mortgage term passes a working age of 70 for any customer. This form asks the customer(s) to confirm they have considered the implications of the term chosen and that they believe they can continue to work until the age indicated. The completed form will be required before we can proceed to offer. Please see also Maximum Working Age.

The types of evidence which can be used to verify anticipated retirement income are as follows:

- Private / Company Pension Forecast Statement dated within the last 18 months

- State Pension Statement dated within last 18 months which must be obtained by the customer directly as an actual statement with their name and address on it (this can be obtained from The Pension Service).

- State Pension Forecast statement issued to the customer directly from The Pension Service with their name and address on it.

- Annuity Statement dated within the last 18 months

The types of evidence which can be used to verify Pension Income already being received are as follows:

For State Pension, War Pension and Widows Pension

- Latest 1 month bank statement

For Company or Private Pension

- One of the following:

- Latest month’s payslip(s)

- Latest bank statement

- Latest pension statement dated within last 12 months

-

See below for variations to the limits set within this table

Lending limits

Lending limits

Up to £570,000

95%

Lending limits

Up to £750,000

90%

Lending limits

£750,001 - £1,000,000

85%

Lending limits

£1,000,001 - £2,000,000

85%

Lending limits

£2,000,001 - £5,000,000

75%

- The maximum loan amount available on an interest only basis is 75% LTV (or for sale of mortgaged property (SOMP) main residence 50%, 60% or 75% depending on the minimum equity requirement). On part interest only/part capital and interest repayment customers can borrow up to 85% LTV with the balance on capital and interest repayment.

See our Interest only section for more information. - For house purchase and remortgage where the total LTV is over 85% all borrowing must be on a repayment basis.

- The maximum loan for standard new build houses/bungalows is 95% and for flats 85%.

- The maximum loan on converted or refurbished properties where the vendor is a builder/developer and the property has been vacated to allow the refurbishment to be undertaken is 80%.

- The maximum loan on remortgages without additional borrowing is 90%.

- The maximum loan on remortgages with additional borrowing is 85%.

- The maximum Loan to Value loan on remortgages of Mortgage Free (Unencumbered) properties is 85%.

- Customer taking out a loan above 75% at application stage cannot transfer from repayment to interest only, within the first 12 months of completion of the mortgage.

- Further advance applications are subject to a limit of 85% LTV.

- Further advance applications will not be permitted within 6 months of completion of the original mortgage.

- Further advance is subject to a minimum loan of £10,000.

- Within these lending limits we calculate the loan available using a comprehensive affordability assessment. There are also Loan to Income (LTI) caps that will apply and may impact the maximum loan. See Affordability, LTI & Income Multiples for further details

- The maximum loan amount available on an interest only basis is 75% LTV (or for sale of mortgaged property (SOMP) main residence 50%, 60% or 75% depending on the minimum equity requirement). On part interest only/part capital and interest repayment customers can borrow up to 85% LTV with the balance on capital and interest repayment.

-

- No more than two lodgers are acceptable providing that they are treated as a family member, i.e. sharing living accommodation

- We do not lend using any income provided by lodger(s)

- If a lodger(s) have exclusive occupation of a self-contained part of the house (e.g. an annex) or your customer does not intend to occupy the property on a permanent basis, this will require further checks as the lodger(s) may acquire legal rights

-

40 years at time of application

-

- Minimum age 18 years.

- Maximum retirement, unless retirement income meets affordability rules.

- Please see also Maximum Working Age

- The maximum age at the end of the mortgage term is 80 years for all repayment mortgages and 70 if any part of the mortgage is on an interest only basis.

-

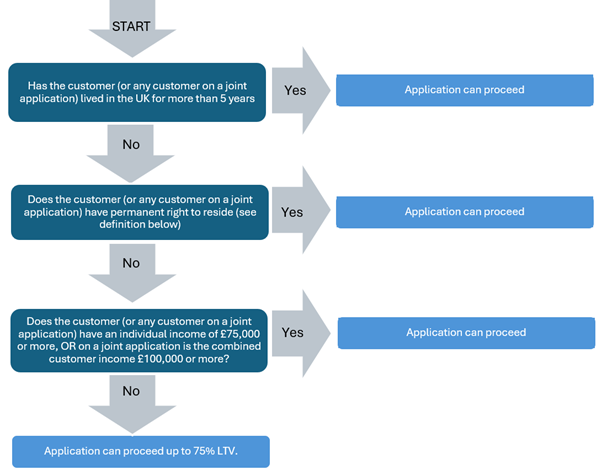

Applications can be considered for non-UK nationals up to 95% loan to value (LTV):

If a next step message shows ‘Proof of permanent right to reside in the UK is required for at least one applicant’ we can proceed with proof that the customer (or any customer on a joint application) has permanent right to reside, OR proof that the customer (or any customer on a joint application) has lived in the UK for more than 5 years. Otherwise the loan to value would have to be reduced to 75% LTV to proceed.

Permanent right to reside can include:

As part of the EU Settlement Scheme EEA, EU and Swiss citizens, living in the UK by 31 December 2020 can apply to continue to live in the UK after 30 June 2021 and will receive one of two statuses which are both acceptable:

- Settled status (awarded where they have lived in UK for at least 5 years and also known as 'indefinite leave to remain under the EU Settlement Scheme').

- Pre-settled status (awarded where lived in the UK for less than 5 years and they can re apply for settled status after 5 years continuous residence in UK has been reached).

- Indefinite leave to enter or remain.

- Republic of Ireland citizens do not need to apply under the EU Settlement Scheme and have automatic permanent right to reside in the UK (no proof of permanent right to reside is required for ROI citizens).

Proof of permanent right to reside could be verified to one of the following:

- An immigration status 'share code' - customers who can view their immigration status online at gov.uk can provide a share code which lasts for 30 days and we can use to view their immigration status e.g. settled or pre-settled status.

- Please note only ‘immigration status’ share codes starting with an ‘S’ are acceptable and not ‘right to work’ or ‘right to rent’ share codes.

- Indefinite leave stamp in passport including: Indefinite Right (or Leave) to Remain/Enter; Right of Abode; 'There is at present no time limit on the holder's stay in the United Kingdom’.

- Biometric Residence Permit showing 'indefinite' rights to remain (this includes 'indefinite leave to remain', 'indefinite leave to enter' or 'no time limit’).

- Letter from the Home Office confirming indefinite right to remain in the UK.

When an application has one customer who has lived in the UK for more than 5 years, or meets the minimum income requirement above, or is a maximum 75% LTV then there is no requirement for the customer(s) to hold a particular type of visa or to have a minimum remaining visa validity.

‘Lived in the UK for more than 5 years …’ means lived in the UK for at least the latest 5 years, but the customer may have spent period(s) aboard within the last 5 years. We will use data provided by the credit reference agencies to determine if a customer has lived in the UK for more than 5 years. Alternatively we can accept proof from the customer e.g. a bank statement, HMRC tax notification, Local Authority Tax Bill or utility bill dated over 5 years ago.

To calculate the income of £75,000 or £100,000 we will include the total of all earned incomes or the latest year’s income for self employed customers.

On Shared Equity and Shared Ownership schemes, to determine if the <=75% loan to value (LTV) criteria has been met, the percentage LTV is calculated as the loan amount against the value of the customer's equity share. (On Shared Equity applications this differs to the LTV used for selecting from the product range which is the loan amount against the total purchase price).

Applications from non-UK nationals holding diplomatic immunity are not acceptable.

-

- Maximum of four applicants

- Two incomes are taken into account for affordability.

- For Bonus/Cash/Sale Of Mortgage Property repayment plans, only the income from the first two applicants will be used to determine the income qualifying criteria.

-

Sub-sales and back-to-back transactions are not acceptable.

A sub-sale occurs when a property is bought and then sold on within six months, i.e. the borrower is buying the property from someone who has themselves bought the property less than six months before. The date of registration at the Land Registry is how we determine the length of ownership.

This means that the current vendor must have owned the property for at least six months before we can accept an application to purchase that property.

A back-to-back transaction is a type of sub-sale where the intervening seller buys from the original seller and sells on to the borrower on the same day or within a few days. We also regard as sub-sales, cases where the seller acquires the freehold (or superior leasehold) title to the property, which they then immediately sell on to the borrower by the grant to them of a lease (or sub-lease).

The following cases are exceptions where it is acceptable for the property to be sold on within six months of acquisition by the seller.

Where sales are by:

- A personal representative of the registered proprietor; or

- An institutional mortgagee exercising its power of sale; or

- A receiver, trustee-in-bankruptcy or liquidator; or

- A developer or builder selling a property acquired under a part-exchange scheme.

- A registered Housing Provider (Housing Association) exercising a power of sale.

We will also accept inherited properties where the applicant is a beneficiary but has not owned the property for 6 months. Applications where the applicant is not a beneficiary of the inherited property and the beneficiary has owned the property for less than 6 months are not acceptable and must be declined. The conveyancer will be responsible for ensuring the application meets the acceptable criteria.

Applications which involve assignable contracts or irrevocable powers of attorney in favour of intervening sellers are not acceptable. Any other structure to the transaction which has a similar effect should be reported to us.

-

Halifax use affordability as a way of assessing how much they will lend. Where the loan requested is above the maximum loan available from our affordability calculation the loan amount should be reduced to proceed or the application will be declined. Please refer to our affordability calculator.

PLEASE NOTE: The affordability calculator will give a guide to the amount we would be willing to lend however, as no credit search is carried out please be aware that this amount is subject to change once the Decision in Principle (DIP) is keyed.

When calculating affordability, the following Loan to Income (LTI) caps also apply. These can be used to calculate the maximum loan that would be available based on income but these are caps and the actual maximum loan could be lower and can be impacted by loan to value and credit score.

Income

LTV

Loans <=£750K

Loans >£750K

Income

<£40K

LTV

0 - 95%

Loans <=£750K

4.49x

Loans >£750K

N/A

Income

£40K - <£50K

LTV

0 - 85%

85.01 - 95%Loans <=£750K

4.75x

4.49xLoans >£750K

N/A

Income

£50K - £75K

LTV

0 - 75%

75.01 - 85%

85.01 - 95%Loans <=£750K

5.00x

5.00x

4.49xLoans >£750K

N/AIncome

>£75K - £125K

LTV

0 - 75%

75.01 - 85%

85.01 - 90%

90.01 - 95%Loans <=£750K

5.50x

5.00x

4.75x (loan <=£500K)

4.49x (loan >£500K - <=£750K)

4.49xLoans >£750K

5.50x

5.00x

N/A

N/AIncome

>£125K

LTV

0 - 85%

85.01% - 90%

90.01 - 95%Loans <=£750K

5.50x

4.75x (loan <=£500K)

4.49x (loan >£500K - <=£750K)

4.49xLoans >£750K

5.50x

N/A

N/A

First time buyer BoostIncome

LTV

LTI

Income

£50K+

LTV

0 - 90%

LTI

5.50x

Income

£50K+

LTV

90.01 - 95%

LTI

4.49x

First time buyer Boost LTI eligibility

- Purchase applications only.

- Any applicant is a first-time buyer (could be one applicant on a joint application, key FTB as first applicant).

- Total income on application is £50,000 or more.

- Loan to value (LTV) is 90% or less.

- Not available on shared equity or shared ownership schemes.

- For applications with any element of self-employed income please refer to the standard LTI table.

- For a small number of applications the overall credit profile may restrict the LTI applied to 5.00x rather than 5.50x shown, or the level of credit score may mean standard LTIs will apply.

Please note:

- If the loan is for an Affordable Housing scheme (Shared Equity or Shared Ownership) then a scheme max LTI of 4.49x would apply.

- If there is any element of self-employed income on an application and the application income is up to £75k, a maximum LTI of 4.49x will apply. For loans where the application income >£75k, and there is any element of self employed income, the normal 5.50x maximum LTI applies up to 75% LTV. For loans >£500,000 to £750,000 of 85.01% to 95% LTV and for loans >£750,000 to £1m of 75.01% to 85% LTV a 4.00x LTI will apply.

- For like for like remortgage customers with no additional borrowing, who receive employed income only, up to 75% loan to value (LTV) and subject to credit score a 5.50x LTI will apply where the standard LTI would normally be below this level. A maximum LTI of 4.49x will still apply for remortgages on an Affordable Housing scheme (Shared Equity or Shared Ownership).

- The level of credit score achieved and overall credit profile may restrict the LTI applied; this may be restricted to 4.49x, to 5.00x rather than 5.50x shown and if income >£75k and loan >£500k where 4.49x shows this may be restricted to 4.00x.

- A different maximum LTI may sometimes apply as a result of the particular product selected.

A property’s Energy Performance Certificate (EPC) rating is used in our affordability calculations allowing us to reflect a more tailored view of energy costs. A customer whose property has a higher EPC rating (e.g. A/B) will generally have lower energy costs than those with a lower EPC rating (F/G) on like-for-like use.

For properties with an A/B EPC rating you may see a small increase in the maximum loan amount available and for properties with an F/G EPC rating a small decrease. There is no change to the maximum loan available for properties with a C, D or E EPC rating or where the EPC is unknown.

For some customers we may make a deduction within our affordability calculation to allow for financial planning commitments the customer may have going forward.

Within our affordability calculation we may apply an affordability adjustment for some contractors to take into account likely business expenses.

In some circumstances we may deduct credit commitments as ongoing in our affordability calculation even when customers have declared an intention to repay these. If the maximum loan available is reduced as a result then the loan amount must be reduced to proceed.

When calculating affordability on interest only loans, Halifax will take into account the monthly premiums payable for the relevant repayment vehicle i.e. existing endowment or new or existing ISA. Please ensure the premium(s) is specified at both DIP and full application.

Affordability must also include future changes to income and expenditure.

Where the maximum loan available is below that requested there may be the option to extend the term (up to retirement) or extend term into retirement (subject to evidence of adequate retirement income).

Please note, if the maximum loan available is reduced due to income not being evidenced at the declared level then the loan amount must be reduced accordingly.

Only in the below scenarios may we consider a loan amount above the maximum loan from our affordability model:

- Existing Halifax mortgage customers with no increase in in loan amount or loan to value (LTV) compared with their current mortgage (see Existing Customers).

- There is additional income, not previously considered, that is expected for the life of the mortgage and can be evidenced in line with our requirements.

For Mortgage Prisoners criteria, please refer to our Mortgage Prisoners section.

-

Important reminders:

Accuracy of keying

- It is very important that all commitments are keyed accurately so we can make an accurate affordability assessment. Please ensure you are familiar with the full list of commitment types that need to be keyed and how different commitments are treated, as shown in the table below

- You should have a thorough conversation with the customer around all their commitments/outgoings and it is recommended that you ask the customer to provide a copy of their credit report from the credit reference agencies to ensure all commitments are included

- Only if there are no commitments should ‘None’ be selected from the system dropdown list

- Please include any additional commitments that have been applied as a credit entry with credit reference agencies/bureaus e.g. mobile phone contracts

Commitments to be repaid on or before completion

- Commitments to be repaid on or before completion must still be keyed and you should select ‘Yes’ for ‘Intend to Repay on Completion’. This includes the existing mortgage on a remortgage application

- Commitments should only be marked as to be repaid where the customer advises it is their definite intention to repay these by completion, this appears plausible given the amount of the payments required and remaining term of the commitment, and you are satisfied they have adequate means to repay these commitments e.g. from available savings or regular income

- Where commitments are keyed as to be repaid a special condition on the mortgage offer will state the mortgage has been assessed on the basis of the declared intention to repay these commitments and it is the customer responsibility to ensure that these commitments are repaid. Completion takes place on the condition that such repayment takes place

- If any commitments were recently repaid but may still be shown on credit reference agencies/bureau information these commitments should be keyed and marked as ‘Yes’ for ‘Intend to Repay on Completion’

- If repaying part of an outstanding commitment, then it must be split and keyed as two commitments: one to be repaid and one to remain

- For all loans above 85% loan to value (LTV) – and for any other applications where we decide that it is prudent – we will deduct commitments as ongoing even where the customer has declared an intention to repay these at or before completion. The loan amount must be affordable with these commitments deducted as remaining

Payslips

- Please check if a customer’s payslips show any deductions that should be keyed as commitments e.g. student loans, child care vouchers or salary sacrifice loan schemes (e.g. cars)

Keying hints

- Where keying commitments with no definitive ‘End Date’ key a likely end date

- For commitments with a monthly payment and no total outstanding balance key the balance as an annual commitment i.e. 12 x monthly payment

- Financial dependants - please see our Dependants section for the definition of child and adult dependants

- Adverse credit history - please see Adverse Credit for guidance on how to answer these application questions

Commitment types to be keyed:

Loans

Loans Commitment type

Notes

Commitment type

Hire purchase

Notes

- Include any car lease or Personal Contract Purchase (PCPs)

Commitment type

Loan

Notes

- Include any secured or unsecured loans

- Include as a loan any monthly payment to a Debt Management Plan/IVA

Commitment type

Buy now pay later

Notes

- Include any deferred payment credit (DPC) e.g. pay in 3 or 4 payments as well as longer term buy now pay later options

- If the customer is still in the payment free period key what the monthly payment will be once these commence

Commitment type

Interest free loan

Notes

- Include any retailer loans e.g. furniture

Commitment type

Student loan

Notes

- If a customer advises that they have not yet started making any payments this does not need to be included, but if they are or are about to start payments, then this should be keyed

- Please check if a customer’s payslips show a student loan is being repaid and should be keyed as a commitment

- When a student loan commitment is keyed it will be deducted in our affordability calculation, even if it is selected as being repaid upon completion

Cards & other credit

Cards & other credit Commitment type

Notes

Commitment type

Credit card

Notes

- Key the current outstanding balance and monthly payment being made by the customer

- 5% of the outstanding balance is taken as a monthly commitment even if the customer declares that they are currently making a lower payment

- If your customer clears their balance in full each month, key the monthly payment to be the same as the outstanding balance and select ‘No’ for ‘Intend to Repay on Completion’

- Include any store cards

Commitment type

Charge card

Notes

- (See under Credit card)

Commitment type

Overdraft

Notes

- Key the current outstanding balance and monthly payment being made by the customer

- 5% of the outstanding balance is taken as a monthly commitment even if the customer declares that they are currently making a lower payment

- If your customer clears their balance in full each month, key the monthly payment to be the same as the outstanding balance and select ‘No’ for ‘Intend to Repay on Completion’

Commitment type

Mail order

Notes

- Key the monthly payment and balance as confirmed by the customer

Family

Family Commitment type

Notes

Commitment type

Child care

Notes

- Include any nursery costs, childminder costs, child care vouchers and before/after school clubs

- Please check if a customer’s payslips show child care vouchers which should be keyed as a commitment

Commitment type

Maintenance

Notes

- Include any payments for an ex-partner or dependent children who are not living with the customer

Commitment type

School fees

Notes

- Key the monthly fees amount as confirmed by the customer

Property

Property Commitment type

Notes

Commitment type

Mortgage

Notes

- On Remortgages the existing mortgage to be replaced with our mortgage must be keyed as a commitment with ‘Yes’ for ‘Intend to Repay’; under source of funds select other and type ‘this mortgage’

- A mortgage ‘type’ must be completed for any mortgage commitment which will usually be either ‘Residential’, or ‘Buy to Let’ if the property is already let or is to be let

- For any Buy to Let (BTL) mortgages please also key the rental income received under ‘Other income’ in the customer’s income section. If the gross rental income received is below 125% of the BTL mortgage payments the shortfall will automatically be deducted as a commitment in our affordability assessment

- If an existing residential mortgage is being remortgaged/converted to a BTL then key a residential mortgage as being repaid and a new BTL mortgage commitment as to remain with the new balance/payment that will apply upon completion

- For any other ‘residential’ mortgaged properties to remain in the background an assumed running cost will be deducted within the affordability assessment

Commitment type

Ground rent

Notes

- If purchasing a leasehold property you must tick ‘Yes’ to ‘Do you intend to purchase a flat?’

- Under Commitment type you will then be able to key the service charge and/or ground rent amounts

- Key £1 if no fee applies

- At Decision in Principle stage if the commitments have not been keyed, as not known, we will use an assumed value for these in our affordability calculation, which may mean that at Full Application when the true details are keyed under the property details page, this could affect the loan amount we are willing to lend

- When a full application is keyed and the service charge/ground rent keyed under the property details, we will use the higher of the value from the commitments screen or property details screen, so there is no need to amend/delete the details keyed under the credit commitments as they will not be counted twice

Commitment type

Service charge

Notes

- (See under Ground rent)

Commitment type

Second home

Notes

- Should be selected if an unencumbered residential property will remain in the background

- Key £1 as running cost and a standard deduction for these costs will be included in our affordability calculation

Commitment type

Rental

Notes

- If the customer has any rental agreements in their name for another property which will continue e.g. a pied-e-terre

Other

Other Commitment type

Notes

Commitment type

Other regular committed expenditure

Notes

- For any other regular committed expenditure which the customer could not, or would not want to stop, and it doesn’t fit into any category

- Anything keyed as ‘other’ will be deducted in our affordability calculation, even if it is selected as being repaid on completion

For Shared Ownership/Shared Equity schemes the rental/interest payments are collected within the ‘Scheme’ details screen and should not be keyed as Commitments.

We will use assumed values for the following within our affordability assessment which means the following do not need to be keyed as commitments:

- Council Tax

- Utility bills e.g. water or energy

- TV Licence

- Insurance

- Travel costs

- Motor maintenance and repair

- Internet and multimedia

- Clothing

- Household shopping e.g. food

If a customer does advise they are paying more for any of these commitments than an average customer would, then you should key these in as a commitment under ‘other’.

-

Where a customer's income comes from a contract and they are not employed on a permanent basis they are classed as a contractor. This will include individuals who are self-employed and pay their own tax, those who are employed via an umbrella company who deduct their tax and people who are essentially employed but on a fixed/short term contract e.g. 12 months.

Contractors can be treated as self-employed or employed for income verification purposes:

Self Employed

Treat as Self Employed if:

- The customer pays their own tax, OR

- Has more than 1 contract, OR

- Has set up a limited company and employs other contractors.

Income is confirmed as standard for self-employed customers.

Employed

Treat as Employed if:

- Tax is paid by the company they work for (or they are employed via an umbrella company who deduct tax) OR

- Contractors who earn more than £500 per day or £75k per annum, OR are an IT contractor on any income, can be treated as employed irrespective if the customer pays their own tax, or classes themselves as self-employed. (The only exception to this is where a customer has more than one contract or they have set up a limited company and employs other contractors, in which case they should be treated as self-employed).

Additionally to be treated as employed the customer must have either:

- 12 months or more continuous employment, with 6 months of the contract remaining, or

- 2 years continuous service (for the last 2 years as at the date of application) in the same type of employment

When we are treating a contractor as employed for income verification these are our requirements:

Contractor who pays own tax, or it is deducted by umbrella company (including IR35)

- Copy of latest contract and latest month’s payslip(s) required (or where payslips not issued latest month’s bank statement).

- Income to be used is the lower of the gross value of the contract or income calculated from payslip(s)/bank statement.

- Gross value of contract is calculated as daily rate on the contract x 5 days per week x 46 weeks per year (or hourly rate x 7 hours per day x 5 days per week x 46 weeks per year). Unless the contract states the actual hours/days worked are lower in which case use these figures.

- Income from payslip(s)/bank statement is calculated by multiplying the gross pay received to give an annual figure and then calculating the income based on a 46 week year (unless the contract states the actual weeks to be worked is lower in which case use these figures) e.g. multiply gross pay on a monthly payslip x 12, divide by 52 weeks and multiply by 46 (or average the gross pay on the weekly payslips and x 46).

- The total gross pay showing on umbrella payslips may be broken down by basic salary, commission, ‘additional taxable income', holiday pay etc. but as long as the contract confirms the contractor is paid via a daily rate, or hourly rate, the income does not need to be split into these separate elements and can all be keyed as basic salary.

- The lower of the two figures calculated is keyed as income and used for affordability.

- For customers who have set up a Limited Company or a Limited Liability Partnership (LLP) the income evidence must be from the actual contracted employer not their own Limited Company.

- Contractors who are set up as a Limited Company may not be entitled to the full income of the contract where there is more than one shareholder. If there are other shareholders, and they are also to be named on the mortgage the income from the contract must be keyed for one customer only and no income from this contract can be keyed for the other applicants that are shareholders. If there are other shareholders, but they are not to be named on the mortgage the income should be keyed to reflect the customer share e.g. if 50% share then 50% of income should be used.

Fixed/Short Term or Agency; tax is deducted by employer (not including IR35)

- The latest month’s payslip(s) must be used to evidence income, or latest 3 months’ payslips where other income is being used.

- Income from payslip is calculated by multiplying the gross pay received to give an annual figure and then calculating the income based on a 46 week year e.g. multiply gross pay on a monthly payslip x 12, divide by 52 weeks and multiply by 46 (or average the gross pay on the weekly payslips and x 46).

Construction Industry Scheme Contractors (CIS)

Applications from customers employed on a Construction Industry Scheme (CIS) Contract will be considered. Income should be evidenced using the latest 3 months consecutive payslips/invoices/statement along with corresponding bank statements (this could be from the same or different contracts).

For example, if income in January, February and March is used, payslips/invoices/statement and corresponding bank statements must be for January, February and March. An average of the latest 3 months income should be used. This average amount should then be calculated based on a 46 week year e.g. multiply the average monthly pay x 12, divide by 52 weeks and multiply by 46.

If no income is received or the customer is unable to provide both pieces of evidence of income, then ‘zero' income must be used for that month.

Customers should be treated as self-employed if they pay their own tax or sub contract to more than one company.

Zero hours contracts

Applications from customers employed on a zero hours contract for over 12 months will be considered. Proof of all income in the last 12 months is required and that total income figure will be used.

Probation

Income from probationary employment is only used where the probationary period is part of a permanent contract. If the contract is purely probationary with the employer having the option to terminate the contract then this income cannot be used.

It is important that probationary contracts are keyed accurately as follows:

Where the applicant receives an offer of permanent employment and the contract states an initial probationary period e.g. three or six months, it should be keyed as 'permanent'. The income will be used in the affordability assessment.

Where the applicant is offered a probationary contract, e.g. for three months, at the end of which the employer has the option to determine if a permanent contract will be offered, it should be keyed as ‘probationary'. The income will not be used in the affordability assessment.

Professional Sports People

Applications will be considered from Professional Sports People where either continuous employment of 12 months or more with 6 months of the contract remaining or 2 years continuous service (for the last two years as at the date of application) in the same type of employment can be confirmed. It is essential to establish that such individuals will have the ability to sustainably meet the monthly repayments as they near the end of their career or if their career should be ended abruptly due to injury.

-

Non-sterling income can be accepted on purchase, remortgage, further advance (FA) and product transfer (PT) applications where a full affordability assessment is required. There is no minimum income level for non-sterling income to be used. For FAs/PTs non-sterling income can be used even if this was not included on the original purchase/remortgage application.

We will accept income in the following five non-sterling currencies: US Dollar, Euro, Australian Dollar, Indian Rupee and Swiss Franc.

The income types we’ll accept in non-sterling are employed basic salary, bonus, overtime and commission. Non-Sterling income cannot be accepted for ‘other income’ types. The only self-employed income acceptable in non-sterling is a partner of an LLP (Limited Liability Partnership) where the income can be keyed as self-employed and is verified to a letter from a finance director.

We can include sterling income and non-sterling income on the same application, but we can only use one non-sterling currency on an application.

Our website Mortgage affordability calculator will collect non-sterling incomes. This calculation is based on current exchange rates so when an application is made they may receive a different rate. When a Decision in Principle (DIP) is keyed the exchange rate to be used on that application will not then change, so the maximum loan available would not change due to any currency fluctuations.

On our income screens you’ll see a new currency dropdown field and should key in the amount in the originating non-sterling currency, not the equivalent GBP amount. We’ll convert the income amount to GBP and apply a haircut of 20% (10% for bonus income) to cover any potential currency fluctuations.

For income verification if payslips show the amount in the originating currency that is sufficient, but if they only show the converted GBP figure you should upload a compensation letter/remuneration statement in addition to the payslip(s). This document should show the income amount in the original currency which is what we will require.

The compensation letter/remuneration statement can be a document that was sent directly to the customer by their employer, or received online but should show:

- Employer name

- Employee name (to match the application and payslip)

- Pay date

- Non-sterling currency using

- Income type e.g. salary or bonus clearly denoted.

Payslips and any other documents must be in English language.

All mortgage applicants must be UK residents which means they must have a ‘primary address’ in the UK. If someone’s primary address is outside the UK and they only have a correspondence address in the UK they are not a UK resident and a correspondence or family member’s address must not be declared as a primary address. A primary address does not need to be the address where someone spends the majority, or even a certain proportion, of their time e.g. they could spend the majority of their time at a foreign address due to working abroad but still have their primary address in the UK. This is not the same as ‘tax residency’ and we do not require customers meet any tax resident requirements.

Non-sterling income is any income other than sterling received by a customer; non-sterling income converted to GBP to be paid into a UK bank account is still considered to be non-sterling income. Channel Islands/Crown Dependencies i.e. Jersey, Guernsey and Isle of Man plus Gibraltar and Falkland Islands should be treated as GBP and not non-sterling. Please note the amount of any ‘haircuts’ are subject to change.

When non-sterling income is used two additional paragraphs will show on the Mortgage Illustration in the ‘Main features of loan’ and ‘Amount of each instalment’ sections. A letter will be sent to the customer after completion if the exchange rate goes down by more than 20% to advise them and confirm the support available if required.

Q – Can you accept a contractor with a contract in a non-sterling currency?

A – Yes, standard contractor income verification requirements would apply; a copy of the contract would be required together with bank statements or payslips to show the actual income being received. If bank statements only show the converted GBP amount received then to consider the application payslips or a compensation letter/remuneration statement would need to be available to show the amount received in the non-sterling currency

Q – What is the treatment for seafarer contractors?

A – The seafarers employment type refers to people who may work in various different roles on a seagoing vessel e.g. on a cruise ship or oil rig. Seafarers can be permanently employed but are most commonly contractors who are responsible for paying their own tax (which includes people who may say they are ‘tax exempt’) and for seafarer contractors the following treatment should be followed:

- Seafarer contractors – non-sterling income:

- Do they receive the equivalent of more than £500 per day or £75,000 per annum?

- Yes – follow our standard contractor policy

- A copy of the contract would be required together with bank statements or payslips to show the actual income being received. If bank statements only show the converted GBP amount received then to consider the application payslips or a compensation letter/remuneration statement would need to be available to show the amount received in the non-sterling currency

- No – the application cannot be considered

- Below the income level required to follow contractor policy they would need to be treated as self-employed, and we cannot consider self-employed income if non-sterling

- Yes – follow our standard contractor policy

- Do they receive the equivalent of more than £500 per day or £75,000 per annum?

- Seafarer contractors – sterling (GBP) income:

- Follow the standard treatment of contractor or self-employed given the customer’s employment basis/income level

- Follow the standard treatment of contractor or self-employed given the customer’s employment basis/income level

Q – Can you accept a self-employed customer where the business receives some income from overseas?

A – If a company is not UK based we could not use self-employed income as we would be unable to evidence this income per our standard self-employed verification requirements. If a company is UK based we will use sterling income as evidenced on tax calculations (SA302s) and tax year overviews as normal ; if a ‘Foreign income’ amount is shown on the SA302 this amount should not be included in the income keyed

Q – How do I key a bonus received in different currencies in each of the last 2 years e.g. previous year bonus in US$ and latest year in GBP?

A – Only the latest year’s bonus could be used. The currency selected would be the currency of the latest year’s bonus. A two year average would be calculated using the latest year’s bonus amount and zero bonus for the previous year

Q – Do customers need to be paid into a UK bank account?

A – No, there is no specific requirement that income is paid into a UK bank account. All applicants must be UK residents as normal

Q – Do payslips need to show UK tax being deducted?

A – No, there is no requirement for payslips to show UK tax being deducted, and they could show no tax or foreign tax being deducted. All applicants must be UK residents as normal

-

- Payslips must show the applicant and employer name, pay date, basic income, gross & net pay and any additional payments being used in affordability

- We will require contact details for the employer so we can request the reference directly from them and this must be returned directly to us.

- We will provide a form the employer can complete and return with their company headed paper, or they can provide a response in their own format as long as all the requested information is included: employer name and address; the employee’s name; employee's start date, contract status and income details (basic salary and any other income elements). The reference must be addressed to the Halifax and quote our reference number. The reference must be signed and dated, and the name and position of the person completing the reference must be provided. Any alterations must be clearly marked and initialled.

- For incomes received less frequently than monthly i.e. Yearly/Half Yearly/Quarterly e.g. bonus or commission, please key the lower of (a) the total income earned in the last 12 months or (b) the average of the income earned in each of the last 2 years. All payslips showing this income for the latest 2 years are required. For commission and non-annual bonuses, only income received from the current employer can be used and if commission/bonus received in the previous year was from a previous employer the 2 year average figure would be calculated using zero for the previous year. For annual bonuses if the latest year’s bonus payment has been received from the current employer a previous year’s bonus received from a previous employer can be included when calculating the 2 year average.

- Hand written payslips are acceptable, but only where the corresponding bank statements are also provided to confirm the income paid by the employer

- Bank statements must show the customer's full name or initial and surname and account number

- Internet bank statements must show bank heading/name and http address

- Benefit Award Letters must be dated within last 12 months and show the applicant name and monetary value of the allowance. The benefit must not be received on behalf of another person, e.g. a dependant.

Income Type

Acceptable?

Main or

OtherKey As

Evidence

Income Type

Additional Duty Hours (including Additional

Responsibility Hours)Acceptable?

Yes

Main orOther

Other

Key As

Additional Duty Hours

Evidence

Latest 3 months’ payslips

Income Type

Adoption Allowance

Acceptable?

No

Main orOther

Key As

Evidence

Income Type

Airbnb

Acceptable?

No

Main orOther

Key As

Evidence

Income Type

Area Allowance

Acceptable?

Yes

Main orOther

Other

Key As

Town / Area / Car

AllowanceEvidence

Latest months payslip(s)

Income Type

AFC Absence

Acceptable?

Yes

Main orOther

Other

Key As

Additional Duty Hours

Evidence

Latest 3 months’ payslips

Income Type

Armed Forces Independence Payments

(AFIP)Acceptable?

Yes

Main orOther

Other

Key As

Pension - Private

Evidence

Latest Bank Statement (where paid gross) or Latest Pension

Statement / Payslip or Pension P60Income Type

Attendance Allowance

(State Benefit)Acceptable?

Yes

Main orOther

Other

Key As

Attendance Allowance

Evidence

Latest Bank Statement or

Benefit Award LetterIncome Type

Attendance Allowance

(Turning Up To Work)Acceptable?

No

Main orOther

Key As

Evidence

Income Type

Bank Holiday Pay (only if it forms part of basic pay and doesn't inflate income)

Acceptable?

Yes

Main orOther

Main

Key As

Basic Annual Income

Evidence

Latest months payslip(s)

Income Type

Basic Salary (including the probationary period of a permanent contract)

Acceptable?

Yes

Main orOther

Main

Key As

Basic Annual Income

Evidence

Latest months payslip(s)

Income from a new permanent job can be used immediatelyIncome Type

Bereavement Allowance (previously Widows Pension. If State Widows Pension, please see below).

Acceptable?

No

Main orOther

Key As

Evidence

Income Type

Bonus

These must not be keyed unless they have actually been paidAcceptable?

Yes

Main orOther

Main

Key As

Annual Guaranteed

BonusEvidence

Latest 3 months’ payslips (or for incomes received less frequently than monthly all payslips showing this income for the latest 2 years)

Income Type

Bounty Payment

Acceptable?

No

Main orOther

Key As

Evidence

Income Type

Bursary

Acceptable?

No

Main orOther

Key As

Evidence

Income Type

Cabin Crew Allowance

Acceptable?

Yes

Main orOther

Other

Key As

Flight Pay / Allowance

Evidence

Latest 3 months’ payslips

Income Type

Call Out

Acceptable?

Yes

Main orOther

Other

Key As

Additional Duty Hours

Evidence

Latest 3 months’ payslips

Income Type

Car Allowance inc. Car Trade Down.

Acceptable?

Yes

Main orOther

Other

Key As

Town / Area / Car

AllowanceEvidence

Latest months payslip(s)

Income Type

Carers Allowance

Acceptable?

Yes

Main orOther

Other

Key As

Carers Allowance

Evidence

Latest Bank Statement or

Benefit Award LetterIncome Type

Cash In Hand

Acceptable?

Yes

Main orOther

Main

Key As

Basic Annual Income

Evidence

Latest months payslip(s) and Bank

StatementIncome Type

CEA (Doctors Excellence Award)

Acceptable?

Yes

Main orOther

Main

Key As

Basic Annual Income

Evidence

Latest months payslip(s)

Income Type

Child Benefit

Acceptable?

Yes

Main orOther

Other

Key As

Child Benefit

Evidence

Latest Bank statement or

Benefit Award LetterIncome Type

Child Tax Credit

Acceptable?

Yes

Main orOther

Other

Key As

Child Tax Credit

Evidence

Latest Bank statement or

Benefit Award LetterIncome Type

Commission

Acceptable?

Yes

Main orOther

Main

Key As

Annual Regular /

Guaranteed

CommissionEvidence

Latest 3 months’ payslips (or for incomes received less frequently than monthly all payslips showing this income for the latest 2 years)

Income Type

Competency Related Threshold Payment

Acceptable?

Yes

Main orOther

Main

Key As

Annual Guaranteed

BonusEvidence

Latest 3 months’ payslips (or for incomes received less frequently than monthly all payslips showing this income for the latest 2 years)

Income Type

Constant Attendance Allowance

Acceptable?

Yes

Main orOther

Other

Key As

Constant Attendance

AllowanceEvidence

Latest Bank Statement or

Benefit Award LetterIncome Type

Continual Professional Development (CPD)

Acceptable?

Yes

Main orOther

Other

Key As

Additional Duty Hours

Evidence

Latest 3 months’ payslips

Income Type

Council Tax Benefit

Acceptable?

No

Main orOther

Key As

Evidence

Income Type

Country Allowance

Acceptable?

Yes

Main orOther

Other

Key As

Town / Area / Car

AllowanceEvidence

Latest months payslip(s)

Income Type

Danger Allowance

Acceptable?

Yes

Main orOther

Main

Key As

Annual Regular

OvertimeEvidence

Latest 3 months’ payslips

Income Type

Delivery Supplement

Acceptable?

Yes

Main orOther

Main

Key As

Basic Annual Income

Evidence